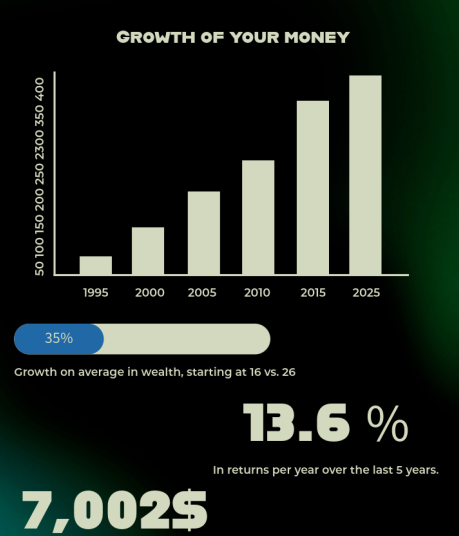

Imagine it’s the year 2040. You graduated from college about 5 years ago, and money is tight. You’re barely covering rent each month. Meanwhile, your friend from high school who invested just $50 a month for 4 years now has over $15,000 saved up. How did this happen? The answer is simple: they started early and let time do the work.

According to Associated Bank, the earlier you start investing, the more your money can grow through something called compound growth. This means you earn returns not only on the money you put in, but also on the returns you’ve already earned. Over time, this creates a snowball effect. Example: If you invest $50 per month starting at age 14 and earn an average return of 8% per year (which is extremely conservative), by age 24, you could have over $10,000. That’s from investing just $6,000 of your own money over 10 years. The rest ($4,000+) comes from compound growth.

Investing means putting your money into financial products (like stocks, bonds, or funds) that have the potential to grow over time. Instead of keeping cash in a piggy bank or a regular savings account where it barely grows, investing lets your money earn returns. This means it can appreciate year after year.

Bonds:

A government bond is a loan you give to the government, and they pay you back with interest. Bonds currently return about 4.2% per year. They’re considered very safe because the only way you’d lose money is if the government fails to repay you (which is extremely unlikely in stable countries like the United States). Returns are modest but reliable.

Stocks:

A traditional security (or a stock) is a small piece, called a share, of a company. This share’s value depends on the company’s performance: it goes up or down. The goal with these stocks is to sell for a higher price than you bought, but this can be very difficult. Keeping up with a bunch of individual stocks is very hard.

Index Funds:

An index fund is a basket; it contains a group of individual stocks. This basket offers a wide range of stocks to ensure your account is diversified. This diversity is important because, depending on the market, certain sections will be up and others will be down. Thus, it is important to diversify your portfolio.

S&P 500:

One example of an index fund is the Standard & Poor’s 500 (S&P 500). Think of this as one of those baskets containing 500 of the largest and most successful companies in America. These include companies such as Apple, Microsoft, and Amazon, among others, across technology, healthcare, finance, and other industries. When you invest in an S&P 500 index fund, you’re buying a tiny piece of all 500 companies at once. Over the long term, the S&P 500 has averaged returns of about 10-11% per year. In the last 5 years (as of 2024), it returned approximately 74.5%, averaging about 15% per year. Past performance doesn’t guarantee future results, and there will be years when the market goes down. However, over long periods (10+ years), the stock market has historically trended upward. Index funds (like S&P 500 funds) are passive investments. This means they automatically include all the companies in the index without you having to pick individual stocks. You don’t need to constantly check your account or make trading decisions. The fund does the work while your money grows over time.

How to Start:

You don’t need thousands of dollars or a finance degree to start investing. Apps like Robinhood, Fidelity, and others let you start with as little as $10. The hardest part isn’t putting money in. It’s deciding where to invest it. According to Schwab MoneyWise, if you’re under 18, you can still invest through a custodial account. This is an investment account managed by a parent or guardian until you turn 18, but the money belongs to you. This makes it easier than ever for young people to start building wealth early. This account lets you continue your investment career seamlessly into adulthood.

Investing might seem like something only adults do, but your youth is actually your greatest advantage. Time allows small amounts of money to grow into substantial savings through the power of compound growth. Whether you put away birthday money, part-time job earnings, or allowance, starting now (even with small amounts) can set you up for financial success in your 20s and beyond. Don’t wait until you’re “older” or have “more money.” The best time to start is now.